How Trump’s Tariffs Pushed Canada Toward Asia — and Quietly Reshaped North American Power

VANCOUVER, British Columbia — While President Donald Trump was threatening tariffs on Canadian goods and floating the idea of turning Canada into America’s “51st state,” a far more consequential shift was unfolding along Canada’s Pacific coast — largely unnoticed in Washington until it was too late to reverse.

Throughout 2025, oil tankers slipped in and out of ports in British Columbia, loading Canadian crude and steering west across the Pacific toward China, South Korea, Singapore and India. By the time U.S. officials fully grasped what was happening, Canada had already offset most of the economic damage from Trump’s tariffs — and permanently reduced its dependence on the American market.

This was not a temporary workaround or a bargaining tactic. It was the largest strategic economic pivot in modern Canadian history, and its effects are now reshaping the balance of power in North America.

The Pipeline That Changed Everything

At the center of this transformation stands the Trans Mountain Pipeline expansion, completed in May 2024. The project nearly tripled pipeline capacity from about 300,000 barrels per day to roughly 890,000 — a technical upgrade with geopolitical consequences.

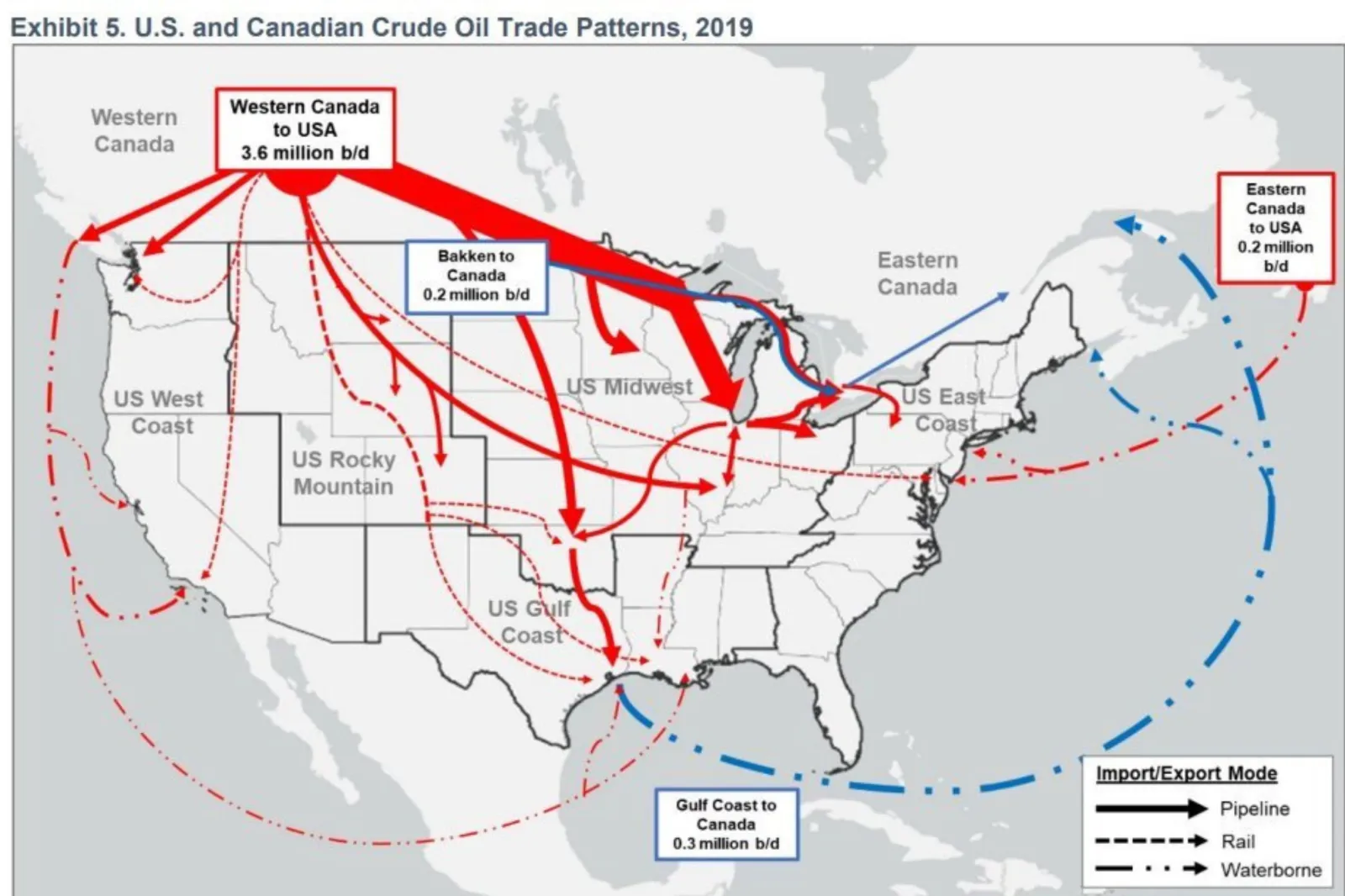

For decades, Canadian oil producers were effectively captive to U.S. refineries. Geography and infrastructure left them little choice but to sell south, often at discounted prices dictated by American buyers. The Trans Mountain expansion shattered that constraint by giving Canada direct access to Asia-Pacific markets — the fastest-growing energy consumers in the world.

By November 2025, nearly two-thirds of the oil flowing through the pipeline was being exported to Asia rather than to the United States. More than three-quarters of the heavy crude shipped from Vancouver-area ports was bound for Asia-Pacific destinations, with only a small fraction heading to refineries on the U.S. West Coast.

China alone has purchased more than 8 million additional barrels of Canadian crude since the expansion came online. South Korea has imported nearly 4 million barrels, while India has taken more than 1.5 million. These are not test shipments. They are long-term contracts tied to established shipping routes — commercial relationships unlikely to disappear even if Washington softens its stance.

Trump’s Tariffs, Canada’s Countermove

Trump’s tariff strategy was built on a long-standing assumption: that Canada had no viable alternative to the U.S. market. For decades, more than 75 percent of Canadian exports flowed south. That dependence gave Washington enormous leverage, and Trump believed economic pressure would force Ottawa to concede.

Instead, Canada adapted at remarkable speed.

According to Export Development Canada, Canadian firms surged into new markets throughout 2025. Traffic to its trade diversification tools jumped more than 90 percent, a sign that businesses were not merely exploring alternatives but actively securing new customers.

Canada has now offset roughly $11 billion of the $18.5 billion in export losses caused by U.S. tariffs — not by waiting them out, but by redirecting trade. China has become Canada’s second-largest customer, joined by expanded exports to the United Kingdom, Singapore, Germany, Japan, Brazil and Indonesia.

Between March and May 2025 alone, the United Kingdom briefly overtook China as Canada’s second-largest export destination, underscoring how rapidly trade flows were shifting.

Infrastructure as Strategy

The Trans Mountain expansion was controversial from the start. The project faced environmental opposition, legal challenges and political resistance. In 2018, the Canadian government under Prime Minister Justin Trudeau took the extraordinary step of purchasing the pipeline from Kinder Morgan to keep it alive — a move critics derided as reckless.

In hindsight, the investment now appears prescient.

The Westridge Marine Terminal, the pipeline’s terminus near Vancouver, can load roughly 630,000 barrels per day onto tankers. Federal agencies are working with the Port of Vancouver to remove remaining logistical bottlenecks, and the pipeline is operating at only about 87 percent capacity — leaving room for further growth.

By contrast, southbound infrastructure is straining. In January 2026, Enbridge rejected about 13 percent of registered crude volumes headed to the United States because production was rising faster than pipeline capacity. Trans Mountain, by comparison, has accepted all volumes fed into the system since opening.

That difference has changed negotiating dynamics. When U.S. refiners offer below-market prices, Canadian producers now have a credible alternative: load the oil onto tankers and ship it west at market rates, free from political pressure.

f

f

A Shift Washington Can’t Undo

For more than seven decades, U.S. policymakers operated on the belief that Canada’s economy would remain structurally dependent on American markets. Trump’s tariff campaign was meant to exploit that reality. Instead, it accelerated Canada’s escape from it.

The International Monetary Fund now projects Canada will post one of the strongest growth rates in the G7 in 2025 and 2026 — even as Trump’s tariffs remain in place. Job losses have occurred in some manufacturing sectors, particularly steel and autos, but U.S. factories have faced similar pressures from higher input costs and retaliatory tariffs abroad.

Trade diversification, economists note, is not easily reversible. Once contracts are signed, shipping routes optimized and supply chains reconfigured, those changes become durable features of the economy.

Even if a future U.S. administration seeks to restore the old relationship, Canada now has options it never had before.

Looking Ahead to the CUSMA Review

The timing of this pivot is especially significant. In July 2026, Canada, the United States and Mexico will enter a mandatory review of the CUSMA trade agreement.

Prime Minister Mark Carney has signaled that Canada is preparing for those talks from a position of strength. He is expected to meet with Xi Jinping to discuss trade, energy and agriculture — a move that would have been unthinkable just a few years ago.

While CUSMA includes provisions limiting free-trade agreements with “non-market economies,” Canadian officials say cooperation with China can expand in ways that remain compliant, particularly in agriculture and environmental sectors.

The End of an Era

Trump’s tariffs were designed to force Canada to yield. Instead, they triggered a historic realignment.

Canada’s energy now flows west as easily as it flows south. Its exporters are embedded in Asian markets. And Washington’s leverage — built over generations — is steadily eroding.

This shift did not happen because Canada wanted confrontation. It happened because, faced with economic coercion, Ottawa chose resilience over dependence.

A quiet era is ending: one in which Canada’s economy was bound almost entirely to the United States. In its place is a more flexible, globally integrated Canada — a transformation that may prove to be one of the most enduring legacies of the Trump years, even if it was never the outcome Washington intended.