Canada’s China Pivot Signals a Fracture in North American Trade

For decades, Canada’s economic destiny has been anchored to the United States, bound by geography, supply chains and a trade relationship that remains the largest bilateral commercial partnership in the world. That assumption is now under strain.

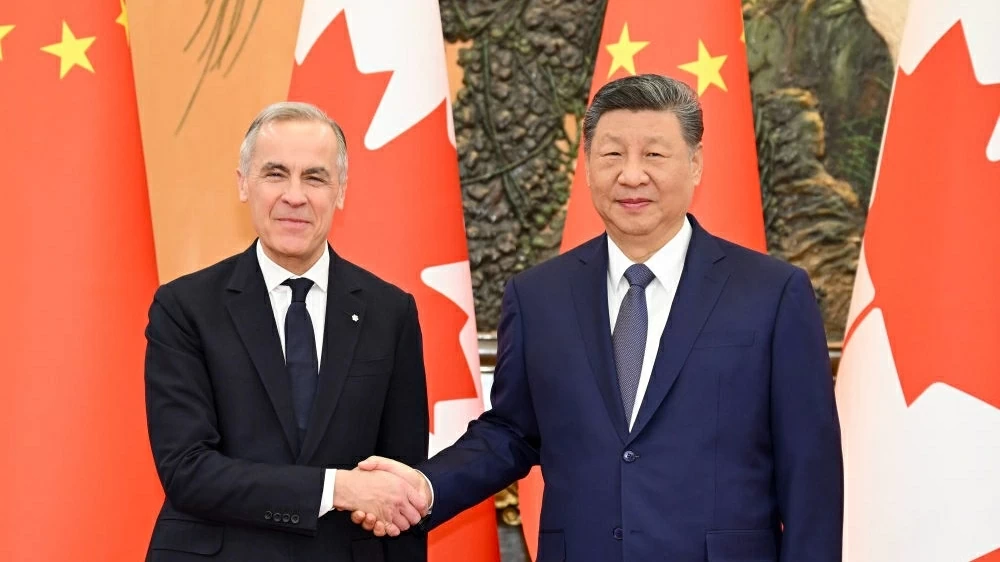

On January 16, Prime Minister Mark Carney stood beside President Xi Jinping in Beijing and announced what Canadian officials described as a “strategic reset” in relations with China — a deal that sharply reduces tariffs on Chinese electric vehicles, restores agricultural access for Canadian farmers and expands long-term energy cooperation with Asia.

The agreement has sent shock waves through Washington, not only for its economic implications but for what it signals politically: a growing perception in Ottawa that the United States has become an unpredictable partner.

A Deal That Changes the Math

At the center of the agreement is electric vehicles. Canada will reduce tariffs on Chinese-made EVs from 100 percent to 6.1 percent, clearing the way for roughly 49,000 vehicles to enter the Canadian market this year, with government projections indicating that number could rise to 70,000 annually within five years.

In exchange, China agreed to slash tariffs on Canadian canola from as high as 84 percent to 15 percent, offering immediate relief to farmers in Saskatchewan and Alberta who have spent nearly a year squeezed out of their largest export market.

On paper, the numbers appear manageable. Chinese EVs would represent less than 3 percent of Canada’s total auto market in the near term. But American trade officials and auto executives say the concern is not volume alone. It is proximity.

“These are vehicles and supply chains that U.S. regulators have explicitly barred from the American market over national security concerns,” said one senior U.S. official, speaking on condition of anonymity to discuss internal deliberations. “They’re now operating directly across our northern border.”

Washington’s Silent Months

The roots of the deal stretch back months, to a period when Canada was seeking support from its closest ally and found little response.

In March 2025, China retaliated against Canada’s EV tariffs with $2.6 billion in duties on Canadian agricultural products. By August, Beijing had escalated further, imposing tariffs of more than 75 percent on canola seeds — a crop that Canada exports more than any other country in the world.

Canadian officials quietly sought U.S. backing. None came.

Then in October, U.S.–Canada trade talks collapsed altogether after President Trump abruptly ended negotiations, angered by an Ontario government advertisement criticizing American tariffs. The decision, widely reported and dissected on social media and cable news, stunned Canadian officials who had spent months in negotiations.

“It wasn’t paused. It was terminated,” said one former Canadian trade negotiator. “That changed the internal calculus overnight.”

Beijing Steps In

While Washington went quiet, Beijing moved quickly.

Carney and Xi had already met on the sidelines of the APEC summit in South Korea in October — the first such meeting between leaders of the two countries in seven years. Chinese state media described it as a “turning point.” Canadian officials now acknowledge it was the opening move in a broader reset.

By January, Carney was in Beijing, finalizing an agreement that extends well beyond vehicles and agriculture. China committed to long-term purchases of Canadian liquefied natural gas, potentially redirecting as much as 50 million tons annually to Asian markets by 2030.

That energy shift alone has raised alarms in Washington, where lawmakers had long viewed Canadian supply as a buffer against volatile global energy markets.

A Political Break at Home

The deal has also fractured Canada’s domestic consensus.

Doug Ford, the premier of Ontario and a political ally of Carney, publicly warned that the agreement risks flooding the Canadian market with low-cost Chinese vehicles without firm guarantees of domestic investment.

“The auto sector doesn’t survive on promises,” Mr. Ford said in a statement. “It survives on factories, supply chains and jobs.”

In the United States, Transportation Secretary Sean Duffy struck a more direct tone, saying Canada would “surely regret” allowing Chinese cars into its market. The comment, widely circulated on X and cable news, was read in Ottawa less as advice than as a warning.

Trust, Measured in Polls

Perhaps the most striking data point is not economic but political.

According to recent polling cited by Canadian media, favorable views of the United States among Canadians have fallen from 54 percent in 2024 to 34 percent today. Favorable views of China, once deeply negative, have risen to the same level.

For the first time in modern polling history, Canadians now view Washington and Beijing with equal levels of trust.

Mr. Carney has leaned into that contrast. Asked directly whether China or the United States was a more reliable partner, he said Beijing had proven “more predictable” and “results-oriented.”

In Washington, those remarks were met with disbelief. On social media, former diplomats and national security officials warned that predictability should not be confused with alignment.

Beyond Trade

The implications go beyond commerce.

During his meetings in Beijing, Mr. Carney discussed Arctic security and Greenland — a topic that has become increasingly sensitive after President Trump publicly floated the idea of U.S. territorial control. Carney later said he found “alignment of views” with China on Arctic sovereignty issues.

That statement has unsettled American strategists who see the Arctic as a core security theater and Canada as a critical partner.

“This is not just about tariffs,” said a former Pentagon official. “This is about whether North America is still operating as a coherent strategic bloc.”

The 90-Day Window

All of this unfolds as the United States–Mexico–Canada Agreement approaches its scheduled review. President Trump has repeatedly dismissed the pact as irrelevant, but Canada now enters those talks with leverage it did not previously possess: an alternative market willing to buy what Washington will not.

Whether the rupture becomes permanent remains uncertain. Diplomats on both sides say there is still a narrow window — perhaps 90 days — to stabilize relations before supply chains, energy flows and political alignments harden.

But one lesson is already clear. Alliances do not collapse overnight. They erode through neglect, unpredictability and the assumption that proximity alone guarantees loyalty.

Canada has not abandoned the United States. But for the first time in generations, it is openly hedging its future.

And once an ally decides it must hedge, restoring trust becomes far harder than losing it.