A Quiet Upheaval in North American Trade: The Collapse of U.S. Auto Dominance in Canada

In the intricate web of North American economic integration, few relationships have been as enduring and interdependent as the automotive trade between the United States and Canada. For decades, American-made vehicles flowed northward with ease, forming the backbone of Canadian dealership inventories and underpinning a shared manufacturing ecosystem that blurred national borders. Yet in 2025, this once-unshakable partnership fractured dramatically. Data from the first 10 months of the year reveal a stark reality: only 36 percent of passenger vehicles imported into Canada originated from U.S. factories—a precipitous drop from historical levels that hovered near 50 percent in the 2010s and over 70 percent in the 1990s. The decline, amounting to roughly a 34 percent erosion in market share relative to recent norms, unfolded not through consumer revolt or product failure but through the blunt force of policy upheaval.

The catalyst traces directly to the reimposition of tariffs under the Trump administration. In early 2025, new levies targeted foreign-made vehicles entering the United States, framed as tools of leverage in broader trade and border-security negotiations. Ottawa responded with calculated precision rather than outright escalation: counter-tariffs on U.S.-built cars, coupled with selective exemptions for manufacturers maintaining production in Ontario. The approach proved surgical, incentivizing supply-chain shifts that insulated Canadian interests while exposing vulnerabilities in the integrated model.

Manufacturers, facing this new uncertainty, acted swiftly. Imports from the United States paused, sourcing rerouted, and dependencies realigned. Mexico emerged as the principal beneficiary, with vehicle exports to Canada surging past $8.4 billion through October—surpassing full-year records and eclipsing U.S. volumes in key months. For the first time in decades, as seen in June 2025 data, Canadian importers funneled more passenger vehicles from Mexican plants than from American ones, a reversal that underscored the speed of market reconfiguration.

The fallout rippled through boardrooms and factory floors on both sides of the border. American automakers, including Tesla and Subaru, redirected shipments—Tesla from German facilities, Subaru from Japan—rendering U.S. production sites sudden liabilities rather than strategic assets. In Canada, the pain proved acute: Stellantis canceled plans for Jeep Compass production in Ontario, shifting it to Illinois; General Motors halted electric van output at an Ontario site; Honda delayed an $11 billion electric-vehicle investment. Thousands of workers faced prolonged uncertainty, with Ottawa issuing default notices over violated taxpayer commitments. These decisions, executives insisted, stemmed not solely from tariffs but from a pervasive climate of volatility that made long-term planning untenable.

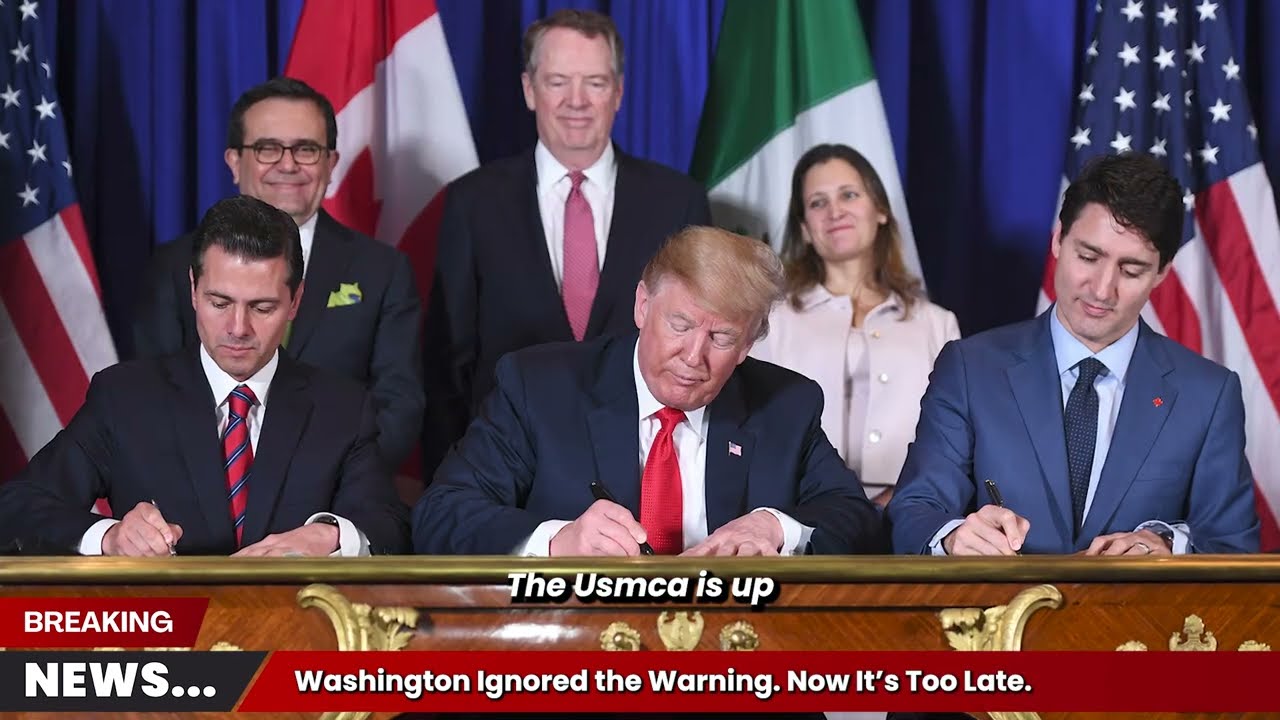

At the heart of the crisis lies the fraying credibility of the United States-Mexico-Canada Agreement (USMCA). Intended as a modernized framework for regional stability, the pact now hangs in ambiguity ahead of its mandatory 2026 review. President Trump, during plant tours and public statements, dismissed its value, suggesting no inherent advantage for the United States and implying survival mattered little. Such rhetoric amplified perceptions of impermanence: tariffs imposed, rolled back, reimposed, and partially exempted created a regulatory whiplash that poisoned predictability—the true currency of global supply chains.

Industry leaders, even from U.S. firms like Ford, voiced alarm. The CEO highlighted how concessions to Japanese imports at around 15 percent granted competitors a $5,000 to $10,000 per-SUV advantage, tilting the field against domestic production despite American assembly. The plea shifted from protectionism to stability; manufacturers no longer sought higher walls but reliable rules.

This shift signals a deeper erosion of American indispensability. For years, U.S. economic influence rested on seamless integration: allies assumed access, factories rewarded markets. Now, reliability trumps loyalty. Companies build redundancy, route around risk, and design systems where American participation becomes optional. Canada’s quiet diversification—toward Mexico, South Korea, Japan—demonstrates that partners can function without heavy U.S. reliance, not out of animosity but self-preservation.

The implications extend beyond autos. If America’s closest ally can rebalance trade flows so decisively, others may follow. Economic power thins not through dramatic rupture but steady dispersal. Trust, once automatic, turns conditional; agreements treated as bargaining chips erode credibility. In global manufacturing, where vehicles cross borders multiple times before completion, friction proves toxic.

As 2026 approaches and the USMCA faces existential scrutiny, the episode raises uncomfortable questions. When predictability vanishes, integration unravels. Influence fades not from challenge but obsolescence. The automotive trade war of 2025, sparked by tariffs and sustained by uncertainty, may prove a harbinger: a silent redesign of alliances, where the center once held by default now risks being quietly circumvented. The numbers tell the story plainly, but the underlying shift in power dynamics may take years to fully manifest.