JUST IN: Canada’s $500 Million CPKC Rail Shock Bypasses U.S. Ports — Trump’s Trade Leverage COLLAPSES Overnight

Canada has quietly executed one of the most consequential trade moves in North America, and Washington is only now grasping the fallout. A $500 million investment by Canadian Pacific Kansas City (CPKC) has created a seamless rail corridor moving Canadian grain directly to Mexico—completely bypassing U.S. ports, inspections, and political pressure. The result is a structural shift in continental trade that leaves Donald Trump with virtually no leverage over Canadian exports.

At the center of the transformation is CPKC, the only single-line railroad linking Canada, the United States, and Mexico. Spanning more than 32,000 kilometers, the network allows wheat harvested in Manitoba to arrive in Mexico City bakeries without touching a single U.S. export terminal. No port bottlenecks. No American inspections. No exposure to tariff threats. Canadian grain now flows south uninterrupted, undermining assumptions that U.S. infrastructure is indispensable.

This new reality was made possible after Canadian Pacific’s $31 billion acquisition of Kansas City Southern, finalized in April 2023 after years of regulatory battles. The merger created North America’s first true tri-national railroad, eliminating costly handoffs between rail operators at borders. One system, one bill of lading, one predictable route. For exporters rattled by trade uncertainty, that reliability is decisive.

CPKC has backed the strategy with massive capital deployment. The company purchased 5,900 high-capacity grain hopper cars, added 100 Tier 4 locomotives, and upgraded infrastructure to handle record volumes. By the 2025–2026 crop year, CPKC expects to move up to 34 million metric tons of Canadian grain annually, with weekly capacity reaching 685,000 metric tons during peak periods. This is not theoretical capacity—it is steel on rails, crews hired, and trains already running.

The symbolism became impossible to ignore when Canadian officials and CPKC executives watched a unit train arrive in Mexico City carrying Western Red Spring wheat from Manitoba. Canadian grain, Canadian railcars, Canadian railroad—Mexican destination. The United States was reduced to a transit corridor, not a gatekeeper. Even as trains cross U.S. territory, they generate only minimal track-access fees, not the port revenue, inspection fees, or logistics income American cities once captured.

Mexico’s enthusiasm is driven by fundamentals. With a population of 130 million and a rapidly expanding middle class, grain demand is rising steadily. Domestic production cannot keep pace, and reliance on the United States has become risky amid tariff threats and policy unpredictability. Canadian wheat offers consistent quality, high protein content, and now, thanks to CPKC, simple and reliable logistics. Electronic phytosanitary certification has further streamlined Canada–Mexico trade, accelerating customs clearance and reducing friction.

For the United States, the losses are tangible. Canadian grain once flowed through Pacific Northwest and Gulf Coast ports, generating billions in economic activity. That traffic is now disappearing. Seattle, Portland, Houston, and New Orleans lose volume, jobs, and revenue as rail shipments bypass them entirely. Analysts warn the shift is permanent, because infrastructure of this scale—railcars with 40-year lifespans, locomotives built for decades of service—cannot be easily reversed.

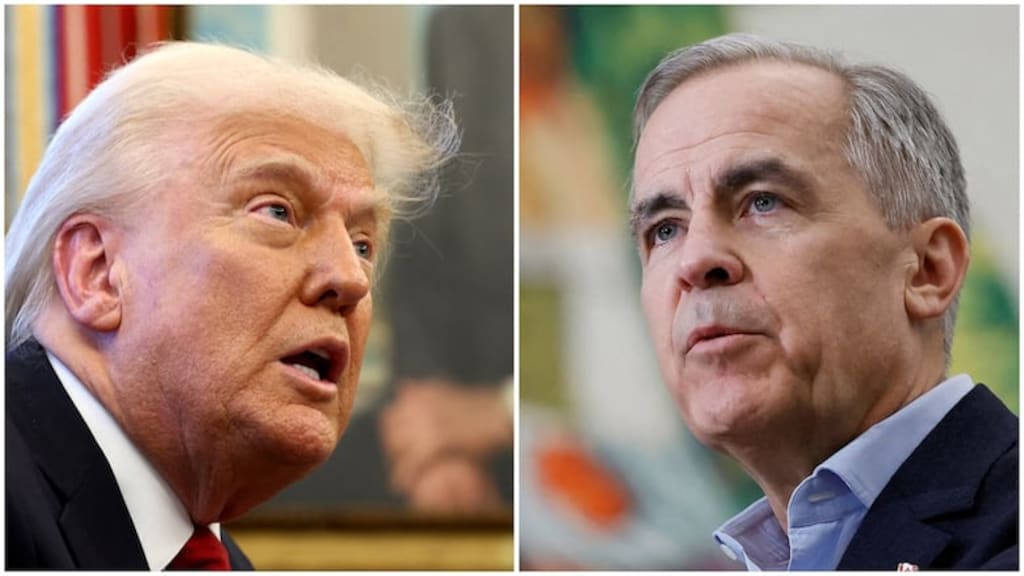

The strategic implications are stark. Under USMCA, the United States cannot block this transit or impose tariffs on goods merely passing through. Trump’s threats lose force when exports no longer depend on American ports or inspectors. Instead of increasing U.S. leverage, trade aggression accelerated Canada’s push for autonomy. CPKC turned chaos into opportunity, building a land bridge that permanently rewires North American grain trade—and leaves Trump watching from the sidelines as his influence evaporates.