Canada’s Dramatic Trade Realignment: A $3 Billion Lifeline Severed and Redirected Eastward

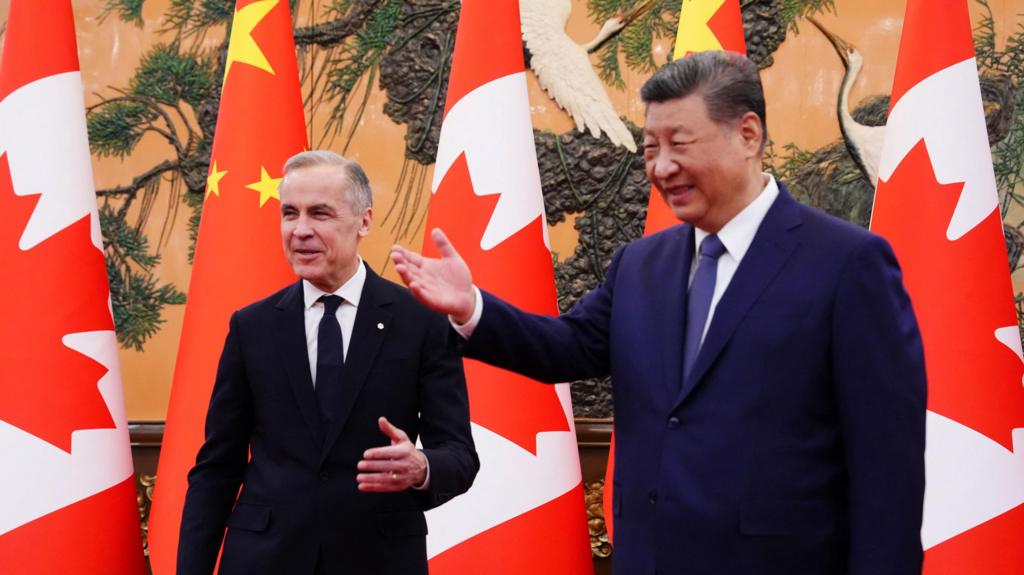

In a stunning economic and geopolitical rupture that has sent shockwaves through North American markets, Canada has executed a bold, overnight pivot away from its traditional dependence on the United States, forging a landmark trade reset with China that slashes tariffs on electric vehicles and canola while unlocking nearly $3 billion in desperately needed export relief for Canadian farmers and processors. Prime Minister Mark Carney, fresh from high-stakes meetings in Beijing with President Xi Jinping, announced the preliminary agreement on January 16, 2026, framing it as a necessary step toward “value-based realism” in a world of escalating unpredictability south of the border.

The deal, born amid relentless U.S. tariff pressures under President Donald Trump, represents one of the most consequential shifts in Canadian foreign economic policy in decades. Canada has agreed to admit up to 49,000 Chinese electric vehicles annually at a preferential most-favored-nation tariff rate of just 6.1 percent — a steep drop from the previous 100 percent levy imposed in 2024 in alignment with American policies. In exchange, Beijing has committed to slashing punishing duties on Canadian canola seed from a combined rate of around 84 percent to 15 percent by March 1, 2026, while removing tariffs entirely on canola meal, lobsters, crabs, peas, and other agricultural products through at least the end of the year. The moves are projected to revive billions in frozen trade flows that collapsed after tit-for-tat retaliations in 2025, when China’s imports of Canadian goods plunged 10.4 percent.

The Backdrop: Trump’s Tariffs and Canada’s Search for Stability

The catalyst for this seismic realignment traces directly to Washington’s aggressive trade posture. Since returning to office in January 2025, President Trump has invoked emergency powers to impose sweeping tariffs on allies and adversaries alike, including steep levies on Canadian goods justified by claims of trade imbalances, migration pressures, and national security concerns. These measures have battered Canadian exporters, particularly in autos, agriculture, and energy, triggering widespread anxiety in industries tied to the U.S. market. Ontario’s auto corridor, employing over 90,000 workers, has faced existential threats as tariff threats loomed over integrated North American supply chains.

Prime Minister Carney, who assumed office in March 2025 following Justin Trudeau’s departure, has repeatedly emphasized the need to diversify partnerships in response to this “unpredictability.” During his Beijing visit — the first by a Canadian prime minister since 2017 — Carney and Foreign Affairs Minister Mélanie Joly openly highlighted China’s relative predictability compared to volatile signals from Washington. The rhetoric was unmistakable: Canada would no longer structure its economic future around a single partner’s mood swings.

Industry Chaos and National Repercussions

The immediate fallout has been chaotic. Canadian canola producers, who endured months of livelihood-threatening barriers after Beijing’s 2025 retaliatory 100 percent duties on oil and meal, now anticipate a rapid resurgence in orders. Futures prices surged on the announcement, with industry groups like the Canola Council of Canada expressing cautious optimism that the relief could restore smoother, more predictable trade with their second-largest market.

Yet the electric vehicle component has ignited fierce domestic controversy. Ontario Premier Doug Ford condemned the deal as “lopsided,” warning that subsidized Chinese imports threaten to decimate local auto manufacturing without reciprocal investment commitments. Critics fear that allowing tens of thousands of advanced, low-cost Chinese EVs — potentially from giants like BYD — could flood the market, undercutting domestic producers and complicating efforts to build a North American EV ecosystem. Proponents counter that the quota system and expected future joint ventures could inject new technology and capital into Ontario’s plants, positioning Canada as a producer rather than mere consumer in the global EV transition.

A New Era of Buffers and Leverage

This is not a outright abandonment of the U.S. relationship — trade volumes with America remain vastly larger — but a calculated diversification. By securing buffers through deepened ties with China, Europe, and others, Canada is shrinking the leverage once wielded by unilateral U.S. threats. The agreement includes broader commitments to energy cooperation, joint economic roadmaps, and revitalized agricultural committees, signaling long-term structural alignment rather than short-term optics.

Markets reacted swiftly, with Canadian agricultural stocks rising while U.S. border-dependent sectors braced for ripple effects. The deal underscores a broader global reconfiguration: as Trump’s “America First” tactics alienate allies, those nations are quietly recalibrating toward more stable, multipolar arrangements.

In Beijing’s freezing parks and grand halls, what unfolded was less ceremony than strategy — a nation asserting control over its economic destiny amid gathering storms. The old equations of dependence are fracturing, and the consequences for North American power dynamics may prove profound and irreversible.